Economic and Monetary Union

-

Available versions :

EN

Résumé

1. Renewed efforts for tax convergence between the Member States

• Recognising the inevitable and legitimate nature of tax competition, but on condition that it respects the fundamental principles of free competition: transparency, loyalty and fairness.

• Going beyond the OECD's recommendations that aim to tax profits made by multinationals, not where they are declared, but where they are generated. This notably includes the definition of "stable establishment" (other than a letter-box branch) and that of tax havens, rules governing transfer prices between branches of the same group, the processing of intellectual property remuneration, the obligation on the part of each company to provide turnover and tax figures country by country. On this latter point, we should note that this information would not be limited to the tax administrations but they would be published openly. This obligation already applies to the banking and financial sector.

• The ability to levy taxes has been eroded by evasion, fraud and fiscal optimization. Social justice is also being challenged, since certain businesses manage to avoid paying taxes. Widespread support enjoyed by the Commission in the Apple affair stresses the timeliness of strengthening European work in this area and notably by the Commission in its capacity as the "competition watchdog", against unfair tax competition: the ban on State aid including tax support, by articles 107 and 108 in the Treaty.

• The CCCTB (Common Consolidated Corporate Tax Base) launched by the Commission that aims to approximate multinational taxation in the Union must be supported, but this has to be enhanced in order to take on board the specificities of the digital economy by taxing digital platforms everywhere where they collate and/or use personal data pro-rata of their volume. At the same time this might also include a kind of ad hoc taxation of the digital giants based on their turnover.

2. Addressing the investment deficit and supporting growth, employment and the sustainability of public finances

• A wider agenda is necessary to increase the Union's capacity to support investment. More effective investment policies would help complete and increase the efficacy of the euro zone's monetary policy. From this standpoint a comprehensive European strategy is required to support investment focusing on three main elements:

• Remedying financial fragmentation and guaranteeing stronger financial integration in the euro zone and the single market - and to do this: the completion of banking union; acceleration and widening of the implementation of single capital union; facilitating the diversification of public securities held by investors to reduce financial risks.

• Making the European Union a more attractive investment goal by fostering sustainable economic convergence and by notably enabling a single regulatory environment for businesses rather than multiple national regulations. There is great potential in the network industry (cross border, transport, telecoms and energy networks). Beyond the adoption of a common legislation it is vital to create an institutional framework that can be effectively and homogeneously implemented.

• Ensuring that public spending focuses on productive long term spending and that at the same time, this increases the economy's capacity to stabilise. During the fiscal consolidation period in the crisis, investment spending in knowledge and infrastructures was the first to be reduced across most countries. The European dimension might play a greater role in the reduction of the pro-cyclical nature of public spending. One possibility would be to finance a greater share of public investment spending at European level and to give the management of this to European institutions. This must however be conditioned by a sufficient level of performance, selection and monitoring of public investment projects. As far as targeting is concerned it would appear opportune to give priority to the financing of international public goods from the point of view of European or world stakes, for which the added value of European work is higher, such as the financing of R&D.

3. Strengthening the efficacy of European governance by the creation of true executive power

• The president of the European Commission, whose post might be merged with that of the President of the European Council, must continue to be the leader of a parliamentary majority and therefore the representative of the political group that won the greatest number of seats in the European Parliament.

• Creation of a European Finance Minister accountable to the Parliament via the merger of the post of President of the Eurogroup and the Vice-President of the Commission responsible for the euro.

• He would answer to the Secretariat General of the Treasury of the Euro Zone whose remit might be extended to the European Stability Mechanism (ESM), transformed into the European Monetary Fund, after its integration into the Union's legal order.

• As far as the proposal of a budgetary capacity for the euro zone is concerned it seems more likely that common budgetary instruments would be acceptable if common needs can be identified. From this standpoint it would be useful to start debate over the common goods that might be managed jointly under the framework of the common institutions.

4. Strengthening the democratic legitimacy of European governance via the closer inclusion of national parliaments and the European Parliament

• It is vital to include national Parliaments in economic and budgetary supervision, for example by widening the role of the Inter-parliamentary Conference on Stability, Coordination and Governance within the Union, created by the TSCG.

• A "euro zone sub-committee" within the European Parliament might be created.

• The legitimate consolidation of the European Parliament must be achieved by a more proportional representation of the population and involves reviewing the distribution of seats per Member State in the European Parliament.

• We should acknowledge a joint right to legislative initiative on the part of the European Parliament and the Council.

5. Strengthening economic and social protection of a common social standards base at European level

• Revising the framework and strengthening the supervision of posted workers (ongoing) to counter the risks of social competition proven in certain areas of work).

• Strengthening the Globalisation Adjustment Fund to support workers more effectively as they face change, as well as economic and industrial shocks.

• Convergence of social rights when they cause direct competition between workers and businesses within the EU. Amongst the measures to adopt might feature the setting of a kind of minimum wage as a percentage of the median salary of each Member State This might mean defining a common minimum, and at the same time leave it to the Member States to go beyond this so that an identical minimum is not set across all Member States together with a reduction of certain national minima, which would lead to accusations of a levelling towards the bottom. The absolute level of the minimum salary would vary therefore according to the median wage of each State in hand.

• From the point of view of the method to be employed it might be useful to find inspiration in the experience gained from the European Monetary System (EMS): setting long term goals. The scope of the social EMS should cover retirement pensions, health insurance, and unemployment insurance. This would mean a form of mid-term convergence of contributions whether this means rates or bases. We note that for example the social contribution rates are double in France in comparison with those made in Germany.

-----------------------------------

CORPORATE TAX IN EUROPE: FROM COMPETITION TO CONVERGENCE?

Alain LAMASSOURE

A problem approached incorrectly for a long time

It is understandable that the French dream of tax harmonisation in Europe: since they have the highest burden - alongside the Danes - vis-à-vis their tax administration, they see a means to lightening their load in this. But our partners have made budgetary savings that we have always refused to do: why would they increase their own taxes so that we can have our way? Yes, tax competition is inevitable: our local authorities practice this between themselves, as do the States at their own level. Yes, it is legitimate: it does not just concern levying rates, but also and at the same time, it involves the quality of the services offered at this price - true competition lies in the cost/effectiveness ratio of public services. And competition between public authorities includes all of the advantages of competition for citizen-consumers.

But this is on condition that it respects the fundamental principles of free competition: transparency, loyalty and fairness. These principles are the base of economic Europe. And yet, from a tax point of view community law has only applied them timidly in the face of the taboo of national sovereignty.

There is one notable exception: the smooth functioning of the Common Market demanded the unvarnished unification of customs rights, which was achieved on day one, as well as the harmonisation and blanket taxation of transactions i.e. VAT. The basic texts harmonising the VAT tax base and the distribution of products and services across a scale of rates were acquired in the 1970's/80's. But as far as the rest has been concerned - even excise duties - taxes that are specific to certain products (tobacco, alcohol, oil products) have not been harmonised. The treaty on the functioning of the European Union therefore limits itself to providing "common rules on competition, taxation and legislation approximation". Articles 110 to 115 prohibit tax obstacles to the freedom of movement and the functioning of the internal market. "National sovereignty oblige" - all Union decisions require the unanimity of the Council of Ministers and only an opinion is demanded of the European Parliament.

The masks fall

The pace of matters was suddenly boosted by a series of events.

Firstly bank secrecy in several Member States enabled the latter to attract their neighbours' savings. The treaty did not prevent this but the spirit of loyal cooperation, which should inspire the European family, was being grossly flouted. It was decisive action by the American Congress that forced Switzerland and other amateurs of bank secrecy to relinquish it under the threat of their bank activities being banned on American soil: the Union leapt at this unexpected opportunity.

Then came the bombshell of the Lehman Brothers' collapse. The G20 leaders realised that it was necessary to agree on a minimum number of common rules worldwide, as much to master the unbridled world of finance, as to guarantee the conditions as fair as possible for competition between the major multinational players: as of 2009 the taxation of multinational companies became part of the OECD's agenda and priorities.

The impact of the Lehman affair was magnified by a series of spectacular scandals, which totally modified the political scope of the taxation of profit. The closed field reserved for the highly specialised, suddenly entered the public arena. Successive revelations about opportunities for tax evasion in Liechtenstein, then the "offshore leaks", "LuxLeaks" and "SwissLeaks" showed that whilst citizens and SME were burdened with an increasing number of taxes, some of the biggest companies in the world were managing to escape payment of almost all of the taxes they owed. According to some conservative assessments by the OECD the annual shortfall lay at around 100 to 200 billion $ worldwide.

The battle for fair competition

By bringing the issue before the public eye the LuxLeaks scandal obliged national and European leaders to address the problem of taxing multinational companies head on. Intelligent cooperation started in 2015 between the Commission, Parliament and the OECD.

The European Parliament introduced a special temporary committee, TAXE, which was responsible for investigating tax legislation, rulings and other harmful administrative practices to fair competition between businesses in all Member States. What has been checked or established with this? - that within the same group, the globalisation of the supply, production and distribution chains increases opportunities for the creation of malicious tax savings schemes. "Double Irish", "Dutch Sandwich", the Belgian regime of "excessive profits", the clever game played by London with the Crown's colonies, varying "patent boxes", tax credit research in France etc... Equally, not everything can be criticised of course, but it would not be too much to say that in Europe every country is someone else's tax haven.

As for the giants of the digital economy, their business model makes the whole idea of profit taxation that had been held since industry's year dot suddenly appear outmoded. Assessing the price of a diesel motor put together in France for final assembly in Romania comes within the competence of a good tax auditor. But how do you establish the legitimate tax location of a digital platform, whose real suppliers are the clients themselves, contributors to this priceless source of wealth to be found in personal data?

At the same time the public outcry has been such that no one can justify the upkeep of the race towards tax avoidance. As they addressed the European Parliament each Finance Minister was irresistibly forced to promise that his country would (now?) be the best pupil in the class. And the representatives of the multinationals outbid each other in their determination to respect the spirit behind the law and no longer just their character. Of course vice paying tribute to virtue is the definition of hypocrisy, but virtue is now becoming fashionable: we should take advantage of this to set it down in stone!

In April 2015, the Commission presented a draft directive making the exchange of information automatic and obligatory vis-à-vis the rulings granted to multinational companies. Only six months were required to achieve the necessary ministerial unanimity. Each may now ensure the protection of their tax potential against the greed of their neighbours. Shortly after this a new text transposed all of the OECD's recommendations (the so-called BEPS[1] action plan) into community law, thereby aiming to tax multinational profits, where they are made and not where they are declared. This notably includes the definition of "stable establishment" (other than a "letter-box" or front subsidiary) and that of tax havens, rules governing transfer prices, the obligation for each business to provide its activity's figures and how it is taxed country by country. On the latter point, going further than the OECD, the Parliament insists that this information should not just be limited to the tax authorities but that it give rise to open publication. Industrial lobbies, please refrain from protesting about the risk of weakening in the face of the competition! This obligation is now being implemented in the bank and financial sector without any regret on the part of the European banks.

At the same time European Commissioner Margrethe Vestager employed the only real weapon at the Commission's disposal in its role as competition watchdog against unfair tax competition: the ban on State aid, including tax aid, with the articles 107 and 108 of the Treaty. A first broadside of four information procedures was launched in the spring of 2015. The Starbucks and Fiat Finances Groups were obliged to pay tens of millions in tax arrears. A truly atomic bomb was launched by the fearless Commissioner as she condemned Ireland to demand 13 billion euro in taxes from one company alone, Apple: the case is now with the Court of Justice. In October 2017 another strike was made against Amazon.

Towards a single tax area in Europe?

A further major stage started in 2017

Crowning the work accomplished to align taxation of multinationals in the Union, the European Commission revived the old issue of quite simply harmonising the definition of taxable profit in all of the Union's countries: the CCTB[2] project. Each State would retain control over its taxation rate but this would apply to an identical base.

The rapporteurs at the European Parliament have contributed to the project to take on board the specificities of the digital economy. To prevent the excessively easy evaporation of a virtual value on extra-terrestrial clouds the idea would be to tax digital platforms everywhere where they collate and/or use digital data, prorated to the number of these: where ever they are processed, this data can always be traced to the address of the private parties involved. Hence Facebook would no longer be able to plead that it has no tax base in France whilst it has 30 million subscribers there! At the same time France has put forward the idea of a kind of ad hoc taxations of the digital giants based on their turnover. Hence in the spring of 2018 the OECD and the Union will meet to come to agreement over the best way to approach this. At long last Europe is finding the courage to address the taboo issue if true economic union.

INVESTING IN EUROPE: A COMPREHENSIVE STRATEGY

Alessandro GIOVANNINI, Jean-Francois JAMET and Francesco Paolo MONGELLI[1]

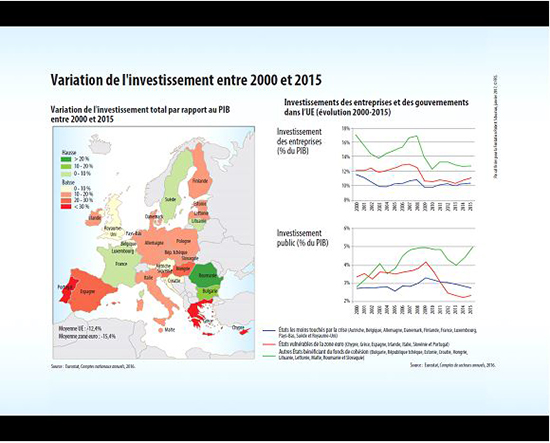

During the crisis, investment in the European Union (EU) and the euro area declined both in terms of volume and as a share of GDP[2]. As the infographic shows, investment in most Member States is significantly lower today as a share of GDP than it was at the start of the century.

Investment has been recovering in the EU since 2013, but at a slow pace and unevenly across countries[3]. In the euro area, it has only just regained its pre-crisis level[4]. Government infrastructure investment also lags behind as fiscal policies have prioritised current expenditure over investment in most countries in the euro area, especially those most severely hit[5]. The overall stock of infrastructures has as a result receded during the crisis. While the corporate sector is driving a slow recovery of investment, investment returns have substantially decreased as uncertainty and business impediments weighed on activity. This also means that the EU and euro area have not been able to close the gap with the EU's main competitors, in particular as regards R&D investment (see Chart 1), which at the moment is below the levels observed in the US, China, South Korea and Japan.

This has had repercussions on growth, employment, and thus the sustainability of public finances, as well as the potential for deleveraging and social cohesion[6]. An alarming side effect is that most European countries have fallen back in scientific, technological and innovation rankings.

This contribution provides a framework for discussing the need for further policy actions at the European level in the area of investment and for articulating existing initiatives and instruments. The aim is to combine both economic and political economy arguments and outline options for improving the use of existing resources and institutions, combining various narratives and perspectives. In doing so, this contribution discusses the role of both public investment as well as policy initiatives that might catalyse private investment.

The EU investment agenda: what has it delivered so far?

The importance of re-launching the European investment agenda has consistently been on the table in European fora since 2012. In that year, the European Council launched 'The Compact for Growth and Jobs'. This initiative foresaw inter alia a €10 billion increase in the capital of the European Investment Bank and the launch of EU project bonds. While the package aimed at supporting an additional € 120 billion investment, already one year after its launch the Commission recognised that it was not used to 'its full potential'.[7] After two years nobody was talking anymore about it, as the European elections and the appointment of the new Commission shifted the political focus from implementation to the announcement of something new, aimed at providing stronger support to the then weak and fragile European economic recovery.

In this context Commission President Jean-Claude Juncker announced in 2014 an 'Investment Plan for Europe', aimed at closing the investment gap by mobilising additional investment over a three-year period. The cornerstone of the plan was the newly created European Fund for Strategic Investments (EFSI), which uses public money guarantees to crowd-in additional private funds to invest in infrastructure, education, research and innovation, renewable energy and in SMEs. In September 2017, the EU legislators agreed on a proposal by the Commission to extend the EFSI by increasing the target size (to at least 500bn) and duration (from 2018 to 2020) of its operation.

So far the implementation of the plan has been more successful than its predecessor: as of September 2017 almost 75% of the initial overall investment target had already been achieved. According to EIB estimates[8], the EFSI loans are expected to add up to 0.7 percent to EU GDP by 2020. While this is a welcome development, the plan has not yet been able to significantly change the investment environment. The reasons for this partial success are threefold. First, the time necessary to prepare, structure and effectively use the funds implies that the macro-economic impact can only unfold over many years. Second, the additional resources committed by Member States were allocated only at projects level. None of the Member States made use of the possibility to contribute to the capital of the EFSI, where the possibility to leverage the resource is higher. As a result the plan's investment amounts remained relatively small from a macroeconomic perspective, at around 10% of annual investment spending in the EU. Third, accompanying policy actions aimed at removing unwarranted brakes to investment both at EU and national level (e.g. by completing and upgrading the Single Market, passing business-friendly reforms in the fields of education, labour market policies and administration) were minimal.

On top of these recent initiatives, about half of the current EU budget takes the form of public investment in a broad definition or is used to support private investment: EU budget funds for investment and other growth-enhancing expenditure, such as on education and active labour market programmes, stand at 0.5% of EU GDP. However, there are intrinsic limitations to the contributions which the EU budget can make to support investment. The EU budget is small in size, equalling roughly 1% of the EU's GDP, and gives rise to difficult negotiations based on the 'juste retour' logic. As a result, the EU budget contribution to the provision of genuine European public goods, such as R&D, has been limited. For instance, although Member States have agreed in principle to increase the share of the "competitiveness for growth and jobs" heading, which is mainly devoted to R&D, infrastructure and education spending, only a moderate increase has been achieved in practice. This is a result of the inability to agree on either decreasing spending on other headings or increasing the overall budget ceiling.

Do we need a new agenda, now?

In view of the above considerations, a broader agenda is directly needed to enhance the Union's ability to support investment. This would make sense from macroeconomic and political perspectives, especially if seen in the current euro area context.

First, from an economic point of view, more effective investment policies have the potential to spur growth, reduce unemployment and thus complement and increase the effectiveness of monetary policy in the euro area. Since 2010, monetary policy has provided the strongest impulses to the economy in a context of fiscal consolidation in the euro area. In particular, it has supported the gradual recovery of investment, especially in the business sector, as financing costs for euro area non-financial corporations have become increasingly supportive to investments plans. Moreover, the increasingly positive contribution from improving demand also supported business investment. From a financing standpoint, the current very accommodative monetary stance remains supportive of public investment. It therefore creates conditions incentivising a more efficient allocation of public resources and thus ceteris-paribus higher productivity, resulting in a more-growth friendly fiscal policy. Increased use could be made of this opportunity.

Second, there are political economy arguments for developing a new investment agenda at the European level. Citizens' trust in the ability of the European economy to prosper has been dented by the crisis, low levels of productivity growth and the resulting "lost decade" for income and employment. A positive narrative is thus needed to create the political conditions for reforms that can lift growth and employment potential. In this respect, supporting investment is comparatively less controversial than other economic policy objectives among Member States, experts and stakeholders. There is however no single "silver bullet" to achieve this objective and there are divergences on priorities (e.g. between advocates of fiscal support and advocates of stronger structural reforms). It is therefore essential to develop an integrated approach that brings together various perspectives and leverages a wide range of economic policy instruments.

Investment as a unifying narrative

Fortunately, a comprehensive European investment agenda can build on ongoing initiatives at European level. So far these initiatives were discussed as part of distinct narratives, but they should in fact be seen as strongly interrelated, as Banque de France Governor Francois Villeroy de Galhau has emphasised[9]. We push this logic to show that supporting investment can provide a unifying European narrative bringing together these initiatives, be they pursued at EU or euro area level. A common narrative would make it easier to explain the ultimate purpose of these separate initiatives and attract renewed political impetus. We identify two main components of such a narrative aimed at addressing the issues revealed by the crisis. First, supporting business investments requires improving the regulatory environment and funding conditions. European actions could act as catalyst for reforms in these areas, thus providing a long-term boost to business investment. Second, during the consolidation period of the crisis, public investment on knowledge and infrastructure suffered the largest reductions in most countries. Europe could play a more important role both on the funding side (i.e. by dampening the pro-cyclicality of such public expenditure), and on the expenditure side (i.e. by entrusting European institutions with the task of the management of the public expenditure in specific areas).

The first component comprises initiatives aimed at strengthening financial integration with a view to ensuring the allocation of capital to its most productive use. The crisis triggered sudden stops in capital flows to certain Member States, revealing the lack of robustness of financial integration. The reversal of capital flows had a major negative impact on financial conditions, driving investment down particularly in economies under financial stress. To reverse financial fragmentation and generate more robust financial integration within the euro area and the Single Market, a number of reforms have been initiated:

- Given the still very important role of banks in European financial intermediation, a central objective has been to create the conditions for a more sound and stable banking sector. There has been significant progress with the establishment of a single rulebook for banks on the EU level and of a banking union on the euro area level. The latter has conferred the supervision of significant institutions to the ECB and created a mechanism and a fund for the resolution of banking crises. However, the banking union is not finalised: the foreseen European deposit insurance scheme and backstop to the Single Resolution Fund have not yet been established, some fragilities endure (e.g. in relation to the stock of non-performing loans in some countries) and the banking sector remain fragmented along national lines. This continues to act as a drag on investment and has the potential to weaken the resilience of the euro area to future shocks.

- Another important initiative is the capital markets union, which aims at diversifying sources of financing by developing and integrating European capital markets. This project is ongoing and the Commission announced its intention to accelerate it and broaden it. Significant progress will, however require addressing difficult political issues, such as establishing more homogenous tax systems and integrated supervision: fragmentation in this respect means that investors face a much more complex investment environment than needs be the case. Moreover, the euro area lacks at present a safe asset, which could provide a tool for diversification of financial risks and allow for deeper, more liquid capital markets. Exploratory work is being carried out on solutions that would facilitate diversification of sovereign debt holdings by investors[10].

A complementary aspect relates to the promotion of the EU and the euro area as a more attractive investment destination through sustainable economic convergence. Fragmentation of the investment landscape also follows from divergences in economic structures, implying unequally competitive business environments across Member States. In this respect, structural reforms by Member States can help by removing idiosyncratic barriers to investment. However, European policies can also contribute to improvements, in particular by allowing businesses to face one regulatory environment instead of 28. Single market policies which the Commission has promoted, for instance as regards the digital economy, also have the potential to facilitate mobility and reduce the cost of doing business across borders (the reduction of roaming fees was a concrete achievement in this direction). There is high potential in the area of network industries and the Commission has appropriately concentrated its initiatives in these areas (cross-border transportation, telecommunication and energy networks[11]). The experience in the financial sector however suggests that beyond the adoption of common legislation, creating an institutional framework that ensures its strong and homogenous enforcement is essential.

The second component of the proposed narrative proceeds from the need to ensure that public spending focuses on those expenditures that improve welfare in the long run and, at the same time, increase the stabilising effects of public spending. Looking at past years, it emerges that when countries experience recessions or crises and thus public finances are tight, public investment is often the first budget line to be cut. For instance, public investment accounted for half of all expenditure cuts in Spain, three quarters in Portugal and almost all of the primary expenditure cuts in Italy. It is natural that a central part of the response to a crisis is provided by automatic stabilizers, whereby spending on social services increases as unemployment and other public transfers rise. At the same time, when fiscal consolidation becomes necessary, cuts to public investments may create allocative inefficiencies and, above all, hurt medium-term growth prospects of a country. The IMF estimated that in the advanced economies an increase of 1 percentage point of GDP in the government investment spending translates, on average, to a greater output by 0.4 per cent in the same year and 1.5 percent in the fourth.[12] This is conditional on an adequate level of efficiency, selection and control of public investment projects so that they effectively address real investment gaps.

A way to partially remove the negative bias against public investment in the expenditure mix would be to move some investment expenditures to the European level and entrust European institutions with the task of the management of the public expenditure in such areas. On the resource side, this would require a well-defined source of income for financing the required investment stream and the necessary political support for it. The latter requires a careful design and focus of such an investment capacity, as well as strict control of expenditures. As regards the policy areas to be targeted, it would seem appropriate to prioritise the supply of supranational public goods and matters of European or global significance, where the European value added is higher. Some examples already exist, such as the recently launched Galileo global navigation satellite system. As regards design, strong institutions and rules are needed to manage such expenditures. Public sector failure and misspending of funds is indeed a major risk: the IMF has recently shown that many G20 countries, and not just emerging economies, need to strengthen the efficiency in the management of public investment management.[13] Europe could make a difference in this field by developing a strong governance framework in line with best practices to oversee the funding, management phases, and monitoring of project implementation.

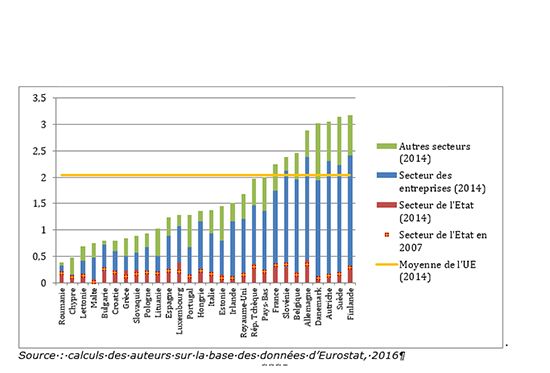

R&D expenditures provide a good illustration as to how such a narrative could be applied. Less than 10% of public expenditure on R&D in the EU is financed at European level, compared with ca. 90% Federal funding in the US[14]. The fundamental justification for government support for R&D relates to market failures: as a public good with strong externalities and that can in some cases benefit from large economies of scale, the risk is that nationally fragmented financing and unnecessary duplication of research would not result in an optimal level and effectiveness of investment. In this perspective, Europeanised public funding for R&D[15] can optimise the use of public resources, "crowd in" private resources and thus achieve positive spillovers leading to positive social rates of return. Centralised funding does not prevent a decentralised implementation of R&D projects Moreover, the empirical literature points to high, suboptimal procyclical patterns of R&D spending and innovation, both in the public and private sector. Moreover, the heterogeneity of R&D expenditure among European countries (illustrated in the chart below) is not consistent with the public good nature of R&D and the need for the EU as a whole to reduce its investment gap in R&D vis à vis competitors.

R&D expenditure in the EU by sectors (as % of GDP)

Source: authors' elaboration on Eurostat data, 2016

Source: authors' elaboration on Eurostat data, 2016

***

In his famous declaration on 9 May 1950, Robert Schuman argued that European countries needed to realise "that fusion of interest which is indispensable to the establishment of a common economic system". He was speaking of coal and steel production. Shortly after the celebration of the 60th anniversary of the Treaty of Rome and as new European initiatives are being proposed, the same vision - a "Schuman Plan" - could be used to bring forward a comprehensive strategy for investment in Europe. In creating the regulatory conditions for successful economic integration and in jointly financing European public goods, such a strategy would deliver tangible benefits while focusing on areas where European initiatives have clear value added, thus respecting the principle of subsidiarity.

EUROPE: RESPONDING TO THE DOUBLE EXECUTIVE AND DEMOCRATIC DEFICIT

Thierry CHOPIN

Since the start of the euro zone crisis priority has been given to strengthening the economic governance of the Economic and Monetary Union (EMU) which was understandable in the beginning. Yet, at the same time problems involving democratic legitimacy have not been taken into consideration in the same manner[1].

With this in mind the following discussion aims to provide some elements about the context and an analysis of the limits of the Union's political system, which not only typifies the euro zone, but also that of the European Union in terms of democratic and executive deficit faced by the EMU (1); making recommendations to help solve the double deficit of political leadership and democratic legitimacy that is affecting the euro zone and more widely, the Union (2).

Background

The limits of the Union's political system

In answer to the crisis, in recovering their sovereignty in the face of the markets, and therefore being able to their ability to decide over their future, the States of Europe, notably those in the euro zone have tried to consolidate EMU with emergency measures, but without changing its political nature.

Financial solidarity instruments have been introduced with the European Stability Mechanism and the Bank Resolution Fund. Stricter common rules have been adopted in an attempt to avoid the accumulation of fiscal, macro-economic and financial imbalances that were responsible for the crisis. The ECB has especially played a decisive role with its monetary policy and its acquisition of new bank supervisory competences.

But, at the same time the euro zone has made very little progress from a political point of view. It was all too obvious that decisions could only be taken at national or European level in case of emergency. However this constraint has had a significant cost, both economically and politically, since it has reduced the area of political choice.

The emergency aside, the capacity to take decisions seems extremely reduced: repeated, conflictual, protracted negotiations have highlighted the limits of the intergovernmental model[2], in which diplomacy prevails over democracy. To be more precise, each Member State privileges its national democratic legitimacy and European democratic legitimacy has been unable to settle conflicts between national democratic mandates, the sum of which does not produce a European democratic mandate. The result of this is increasing frustration that is fuelling Euroscepticism. And in this vicious circle, this frustration makes political union, which would lead to conditions for more legitimate integration, even more difficult to achieve.

Moreover, the management of repeated crises has shown that diplomatic negotiating time is too slow and a source of high anxiety. The outcome of these negotiations is always uncertain and decision making lacks transparency, which allows each to blame the other for the result. Lastly, this system leads to the feeling that there has been a game of "bluff" or "Russian roulette". This has nothing to do with the system of constitutional democracy which plans for and provides the necessary decision making instruments in a context of diverging political preferences: the majority votes together with constitutional rules that protect the minority.

Taking the democratic issue seriously

Long term the status quo does not seem sustainable and this might endanger European integration if awareness is not acquired at the highest level of the need to strengthen democratic legitimacy at euro zone level and more widely at European Union level as a whole. It is in this sense that Emmanuel Macron spoke in Athens: "How can we not see that the defeat of Europe after all of these years is also a defeat for democracy? (...). Europe can no longer move forward separately from the people (...) in the same way we have to be brave enough to return to the path of sovereignty and we have to have another type of courage to recover the path to democracy[3]."

For the euro zone to do more than just "survive" and for it to prosper European sovereignty has to be shared within common institutions that are founded on sufficiently strong mechanisms of political legitimacy and accountability. Although this goal now seems clear the approach that dominates in the European institutions, as well as in the Member States, rests on a certain number of presuppositions and raises certain questions:

• Firstly, thought about the reforms to be implemented at European level are most often restricted to the framework of the euro zone. But limiting reform to the euro zone alone (which raises a whole series of problems) should not be a precondition but a potential "plan B". The issue of democratic legitimacy is one faced by the European Union as a whole and not just the euro zone.[4]

The starting point should always be a sincere attempt to move along as 27; if this leads to an insurmountable deadlock, then an attempt should be made to implement the measure in question within the widest possible group of Member States; from this point of view the euro zone is one possibility amongst others. This is how the Union moved forward on the Stability, Coordination and Governance Treaty, to cover 25 States out of 27. An automatic withdrawal to the euro zone would lead to additional tension and frustration within the Union[5].

• Following this, it is striking that the issue of democratic legitimacy is reduced to that of accountability, which is indeed one of the vital but not a satisfactory component. This would mean an excessive reduction of legitimacy down just to accountability.

Democracy is basically founded on three fundamental requirements; the democratic definition of political goals; the democratic selection of accountable leaders before the entire European body politic; the exercise of democratic control over the decisions taken to assess whether goals have been achieved or not. From this standpoint the democratic political system supposes at least two criteria: competition and alternation; what the Union lacks, from a civic point view, lies in the absence of European political alternation, equal to that in the Member States and also in the Federations.

Citizens' representatives within the Union's political institutions do of course enjoy direct or indirect democratic legitimacy: the heads of State and government, who meet in the European Council are appointed after democratic processes; this also applies to the ministers who sit within the Council, as well as the members of the European Commission, appointed by the governments after a democratic process, and who are also invested by the MPs of the European Parliament, elected by direct universal suffrage. However, the representatives of the Member States in the Council owe their presence to the fact that they belong to a government supported by a parliamentary majority: but this parliamentary majority is rarely established following a campaign focused on European issues; and the Council cannot really undergo total alternation, since these members are renewed according to national elections and under a discontinuous and unsynchronized pace.

Only elections appointing MEPs enable the establishment of a direct link between citizens and those holding power at community level; but the fact that MEPs are elected according to a proportional vote and on largely national bases prevents most of the time the formation of a clear majority within the hemicycle in Strasbourg.

Of course the appointment of a Spitzenkandidat leads to a strengthening of the political link between the European elections result and the choice of the President of the Commission. However this system is not adequate: firstly because "parliamentarist" and "diplomatic" rationale interfere in this in a confused fashion[6]; then, because Commissioners are chosen by the national governments, this leads to an intergovernmental Commission in which the Commissioners are also the voice of national interests; finally, because it is not certain that the precedent of Jean-Claude Juncker's election as head of the European Commission in 2014 will form jurisprudence and that the Spitzenkandidat procedure will be respected in the future.

From this standpoint the diagnosis that can be made of the legitimacy crisis of the Union's political regime must therefore be wider than that of a lack of accountability. Europe is a Union of democracies based on a democratic institutional system from a formal point of view, but which is unable to breathe adequate life into the "political" aspect (in the partisan sense of the term) amongst its members[7]. This is a structural obstacle to democratic ownership[8] by the citizens.

In all, only the introduction of a truly "political union" across the European Union, notably based on the pre-eminence of parliamentary and presidential institutions, whose members are appointed by direct universal suffrage, will give European citizens the opportunity to appoint and to reject those who wield power in the Union and of changing the laws and decisions adopted on their behalf.

• Finally the political reform of the European Union and a minima, of the euro zone supposes a prior clarification of what we want to do[9], which has not been the case to date:

- "Simply" reforming the present system whilst retaining the rationale according to which the community institutions function i.e. according to a rationale of a balance of interests and not powers?

- Going further and transforming the European political system into a truly parliamentary regime with a government that is accountable to parliament or even a presidential regime, as in the USA and its corollary - the introduction of a regime with the effective separation of powers?

It is critical to dispel this ambiguity. The nature of the proposals and future stages in terms of strengthening the democratic legitimacy of the European Union and/or the euro zone, depends on the answers provided to these fundamental questions. A debate should be launched on this issue.

Under the second option (privileging the balance of powers rather than a balance of interests) it would be necessary to define and separate more clearly the executive, legislative and judicial powers, as well as to clarify relations between each of them.

In particular in the Union's current institutional system:

- the Commission mixes executive and judicial power;

- the Council mixes legislative and executive power (and even judicial power in terms of economic and fiscal monitoring);

- the Parliament does not have all of the prerogatives held by a national parliament since it does not vote on taxation and it does not have the power of legislative initiative.

In order for citizens to be able to take democratic ownership of the European political system we would have to draw closer to the national political systems with:

- the Commission as the only political executive (government);

- the Court of Justice as the sole guardian of the treaties (and no longer the Commission) (chamber within the Court of Justice) or together with independent authorities (for example in the area of competition);

- the refocusing of the Council's powers on its legislative prerogatives (in view of its transformation into a second house, like the Bundesrat for example);

- the formalisation of the possibility for the European Parliament, the Council and the national parliaments (as part of a "green card" system for example) to put a legislative initiative to the Commission.

What should be done? Responding to the double deficit of political leadership and legitimacy at European level[10]

Creating a genuine European executive power

The crisis that has affected the euro zone for nearly 10 years raises a challenge in terms of leadership, coherence and efficiency for the governance of Europe[11]. In exceptional situations, which demand that the European Union and its Member States provide answers to the problems that they are experiencing, Europeans are discovering with frustration the limits of European governance and its "executive deficit"[12]: weakness of the European executive; the polyarchical nature of the community institutions and its corollary, a lack of clear political leadership; competition between the institutions and the States; slowness and unpredictability of the negotiation process between Member States. As for the euro zone, leadership is assumed by the ECB, which has no other power but its own and which has no strong political correspondent; the lack of an executive more legitimate than the Eurogroup is a particular problem in this instance.[13]

With this in view solving the problem of Europe's "executive deficit" necessarily implies the creation of a clearer, more legitimate and more accountable leadership:

· The President of the Commission leader of a parliamentary majority, representing (appointed in advance) of a political group which has won the greatest number of seats in the European Parliament

This interpretation of article 17.7 TEU seems to have been fulfilled - with the election of Jean-Claude Juncker as the head of the Commission in 2014. However, we shall have to wait until 2019 to see whether this procedure has set a precedent respected by all of the players in the Union's institutional game.

This is the inevitable starting point for any agenda that aims to politicise the functioning of the European Union. However, since the Treaties are ambiguous on this issue, this acquis is still a fragile one. Indeed, the European political parties must first play ball and then the European Parliament has to be able to assert itself before the Council which may - as was the case in 2014 - aspire to interpret the latter article[14] in a minimalist manner.

However, even if this measure became the norm, without adapted supportive measures, like those set out below, it would not be enough.

The merger of the position of President of the Commission and President of the European Council.

• The Convention, which laid out the project for the European Constitutional Treaty, did not go as far as this for fear of giving too much power to one single person. But the Lisbon Treaty does not reject this possibility in the future: the European Council would simply have to appoint the same person for two posts, which would lead to greater coherence, thereby substituting the danger of competition inherent to the present system. It was in order to open up this path that the ban on the accumulation of European posts with a national mandate was retained in the Lisbon Treaty, whilst that with another European mandate was withdrawn. It offers the following advantages:

- It avoids rivalry that is potentially damaging to the efficiency and legibility of the Union's work;

- It would allow the Union to speak with one voice;

- It would create a position high in democratic and intergovernmental legitimacy;

- It would simplify the institutional structure and lend it a more personal aspect, which undoubtedly is a necessary prior condition to greater identification (whether this is positive or negative) between the Union and its citizens.

Using this possibility would imply definitively granting a major political role to the President of the Commission, who would enjoy community and intergovernmental legitimacy and be politically accountable to the European Parliament.

Such a modification does not require the modification of the treaties. An interinstitutional agreement would be sufficient[14].

This single President could be elected by indirect universal suffrage according to the model in force in most of the European Union Member States (appointment by parliament), which would suppose that the European Council commits - even informally - to the appointment of the candidate put forward by the majority party or coalition in the European Parliament to the post of President of the Commission.

As the treaties stand the European Council is allowed to propose (i) as President of the Commission the candidate put forward by the winning party in the European elections (which would be in line with the obligation provided for in the treaties that the European Council takes the result of these elections into account) and (ii) elect as President of the Council the President of the European Commission[16].

• In the meantime a revision of the appointment procedure of the President of the European Council is called for.

The appointment of H. Van Rompuy, just as that of D. Tusk was the result of negotiation between the heads of State and government, without public debate open to the citizens. As long as the appointment of the holder of this position does not evolve towards a merger with the Presidency of the Commission, a procedure that becomes a high point in European debate will have to be developed by:

- demanding a real declaration of candidacy, together with a clear political programme by each candidate, and at the same time ruling out the possibility of this person acceding to this post without fulfilling this prior condition;

- organising a public hearing of the candidates and a public debate between them;

- making the debate and the vote of the European Council on this issue public.

• The position of President of the Eurogroup should be merged with that of Vice-President of the Commission responsible for the euro, in order to create a Minister of European Finance who is accountable to the European Parliament[17]. Although this kind of proposal seems to enjoy increasing political support, his role would have to be defined:

- He would use the Eurogroup work group for the preparation and follow-up to euro zone meetings and the Economic and Financial Committee in view of meetings involving all of the Member States.

- Under his command he would have the General Secretariat of the Treasury of the euro zone whose remit would depend on the goals of on-going budgetary union, notably via insurance mechanisms and existing budgetary instruments. The Euro Zone Treasury's tasks could be extended the European Stability Mechanism (ESM), transformed into the European Monetary Fund, after its integration into the European legal system, which would suppose a treaty change.

- The question has been raised regarding the euro zone's budgetary capacity to enable the stabilisation of macroeconomic shocks. However this proposal is encountering the reticence of some governments and some public opinion, notably in the countries of Northern Europe in terms of moving towards the greater pooling of risks, which is leading to fears of "a transfers union". It seems more likely that common budgetary instruments would be acceptable if common needs are identified. From this point of view it would seem opportune to start a debate over common goods that might be managed under the framework of common institutions. Associated with the "regalian" dimension of the present challenges, amongst the potential common goods feature investment in R&D, in cross border networks and in the sphere of defence. Incidentally it is striking that this investment spending is generally centralised in the federal States.[18]

- The creation of an independent European budgetary committee might provide a solution which would circumvent a risk inherent to this merger: the European Minister of Finance being able to "demand sanctions against a State and then chair the Council during which this proposal would be validated or rejected?"[19]; the independent European budgetary committee would be able to "externalise the supervision of excessive deficits by giving this task to a discrete authority from the departments of the DG Economic and Financial Affairs (ECOFIN), (...) over which the Commissioner would have no authority. The introduction of an independent budgetary committee of this nature would free the Commissioner of his role as prosecutor and allow him/her to accumulate his/her office with that of President of the Eurogroup."[20]

From this point of view the fact that the appointment of the members of the European budgetary committee, established on 1st November 2015, depends uniquely on the competence of the Commission and its departments' secretariat, raises the issue of the real independence of this committee. The rules of the appointment of its members and its functioning must therefore be revised in view of achieving greater independence[21].

- The Vice-President of the Commission and the Council responsible for the euro and its economic affairs would be the face and voice of the euro policy. He/She would be in charge of communicating the Eurogroup's decisions and of the euro zone's external representation within the international financial institutions, notably at the IMF. He/She would be responsible for explaining how budgetary or structural polices of the euro zone member states form a coherent policy mix with the ECB's monetary policy.

- Finally, he would have to report regularly to the Inter-parliamentary Conference.

The remit of the Vice-President of the Commission and the Council responsible for the euro and for economic affairs could be defined under the Eurogroup's Protocol.

Strengthening the democratic legitimacy of European decisions by national parliaments and the European Parliament

In terms of strengthening democratic legitimacy national parliaments and the European Parliament have a decisive role to play.

Involving national parliaments in economic and budgetary supervision

Beyond the work of supervising the governments of the Member States by national parliaments (the intensity of which is variable depending on the States), this might involve:

• developing the role played by the Interparliamentary Conference on Stability, Coordination and Governance within the Union created by the TSCG[22].

To do this the format of the Inter-parliamentary Conference would have to be changed (since it involves too many participants), for example in a format of ECON+2 participants per national parliament and be provided with an explicit mandate (failing which it would not have any power and would only be a forum), for example in terms of budgetary supervision.

This Inter-parliamentary Conference would be given an important role in the economic and budgetary supervisory mechanisms planned for EMU Member States:

- its two annual meetings should take place at key points in the European Semester (November/December after the annual assessment of growth and in June after the draft recommendations have been made by the European Commission on the stability and reform programmes and before the adoption of these recommendations by the Council[23];

- it would meet for regular sessions which might be completed by the convocation of exceptional sessions;

- on the base of the reports presented by the Member States and the Commission (which should lead to the establishment of a consolidated vision of the euro zone's public accounts), and also the fact-finding missions that it might launch under its own initiative, this Conference could check on the strength of the euro zone and the respect of the commitments made by the Member States;

- it would also need to be informed of the progress of the measures taken as part of the conditions set by the aid programmes;

- finally, it would have the power to summon the Member States' Economy and Finance Ministers, members of the European Commission (vice-presidents, commissioners) responsible for economic, financial and monetary issues, the president of the ECB, the president of the Eurogroup as well as members of the European budgetary committee for hearings.

A revision of the treaty would be required according to a simplified procedure provided for in article 48-3 TFEU. However, according to the Inter-parliamentary Conference's perimeter of competence, a modification of the treaties according to the ordinary revision procedure cannot be ruled out (IGC preceded by a convention).

An institutional modification in the monetary area (for the hearing of the President of the ECB, if he is obliged to attend on invitation of the Inter-parliamentary Conference) is possible according to the simplified revision procedure provided for in article 48-6 in the TEU, but this would require a decision from the European Council deciding unanimously after consultation with the European Parliament, the Commission and the ECB.

Strengthening the role and legitimacy of the European Parliament

Beyond the initiatives taken by the European Parliament to strengthen parliamentary supervision under the European Semester (notably in the shape of "economic dialogue" between the Parliament, the Council, the Commission and the Eurogroup) this might involve:

• Creating a "euro zone subcommittee" within the European Parliament on the basis of a simple modification of its internal regulations. The progress of the euro zone's integration raises the issue of strengthening differentiation from a political and institutional point of view. As an example, in order to reinforce the legitimacy and democratic supervision of European decisions on EMU, the question of creating a specific euro zone assembly has been raised. The European Parliament would evidently prefer this assembly not to compete with it and for it to be one of the sub-committees, in the same way the Eurogroup is a sub-committee of the Ecofin Council and the euro zone summit is a sub-committee of the European Council. For his part the President of the European Commission "is not keen on the idea of a euro zone specific Parliament. The euro zone Parliament is the European Parliament"[24]. The Treaties indeed provide that all of the Union's States will join the EMU. The only exceptions are the UK and Denmark, but a majority of the British citizens decided on 23rd June 2016 that their country would leave the European Union and Denmark has chosen to peg its currency to the euro, thereby guaranteeing a very close fluctuation band of the Danish crown vis-à-vis the single currency as part of the European exchange mechanism. Hence, after Brexit the overlap between the euro zone and the rest of the Union will be greater and it will therefore not be as important to develop specific euro zone instruments. On the long run it would be possible to envisage convergence between the European Union and the EMU, which might facilitate the institutional development of the euro zone, without having to turn to legal acrobatics and the creation of ad hoc structures in the shape of intergovernmental agreements. But in the meantime the realignment of the two main levels of integration, the institutions of the euro zone would be accountable to "the euro zone sub-committee" within the European Parliament. The chair of this sub-committee would also be invited to speak at the Eurogroup meetings and the euro zone summits[25].

This modification might be made as part of a revision of the Eurogroup's Protocol.

• Representation that is more proportional with the population would enhance the democratic legitimacy of the European Parliament. At present the European Parliament is far from the principle of fair democratic representation: the number of MEPs per inhabitant is for example twice as high in Finland than in France. But since citizens should all have the same political rights in a democratic system their vote should carry the same weight[26]. In other words the number of inhabitants per MEP should be the same in all countries (with a minimum representation however to guarantee that even the least populous States are represented)[27], which is an objective criteria that is difficult to challenge. But given the significant growth in the powers of the European Parliament as the Treaties have progressed, strengthening the democratic legitimacy of this institution, which is moreover, the only one to be elected by direct universal suffrage, is a real stake, as recalled by the jurisprudence of the German Constitutional Court[28].

A modification of this nature would require a revision of article 14-2 TEU according to an ordinary revision procedure of the treaties (IGC preceded by a Convention).

• Recognising the right to joint legislative initiative by the European Parliament and the Council. This does not mean restricting the prerogatives of the Commission but rather more adding an element of democracy to the final stage of the community decision making process. Sharing the initiative between the Commission (which would retain this prerogative), the MEPs and the governments of the Member States (in the shape of a right to joint initiative between these two houses of European legislative power) would have double added value in comparison with the system that is currently in force: by firstly allowing response to democratic requirements on which representative democracy is founded (in which the executive and legislative bodies share the power to put laws forward); by giving citizens the feeling that they are being heard and that their representatives - both European and national - are able to relay their wishes[29]. This innovation might be presented as a complement to the citizens' right to initiative introduced with the Lisbon Treaty. A modification of this nature would require a revision of the treaties (art. 225 TFEU) according to an ordinary procedure (IGC preceded by a Convention).

***

Euroscepticism is still running high in many Member States and the citizens' mistrust of the European institutions raises a major political challenge for Europe: either the leaders of Europe are able to agree on sufficiently concrete steps to take in response to the criticism made about the system's democratic legitimacy deficit and its executive deficit, and via this progress, help towards providing European citizenship with meaning; or they run the risk of seeing Euroscepticism grow stronger if steps towards integration do not go hand in hand with democratic control and sufficient decision making power. Many Europeans might then withdraw back towards their national identity, which they feel will be the only one that can guarantee them their political rights.

"SOCIAL EUROPE", A WAY FORWARDS INTEGRATION

Thierry CHOPIN and Alain FABRE

Introduction

In the face of the euro zone crisis, whether this implied sovereign debt or the resulting banking crisis all in all Europeans found satisfactory answers: the euro zone became aware of the lack of - even absence of - instruments and institutions that are coherent with a single currency regime. Generally speaking the Member States undertook a strategy which was mirrored by a drastic budgetary adjustment and structural reform programme, notably in the labour market and by the introduction of federal financial regulation instruments: the European Financial Stability Facility, the European Stability Mechanism, and Banking Union. Finally and possibly the most important factor, the European Central Bank - supported by the extent of the reforms launched and the adjustment programmes, continued its transformation into lender of last resort. In 2017, with the crisis, the ECB became a central bank in its own right, which it was not in its initial form.

But the source of European imbalance - as highlighted with the Lisbon Strategy (2000) generally lies in a lack of competitiveness but also because of the disparity in performance between Member States, which increased sharply up to the start of the crisis. According to data provided by COE-REXECODE, unit labour costs in industry and market services increased by 48% in the euro zone since 2000.In Germany, in spite of a vigorous rise in remunerations since 2012 they rose by 34%, whilst in Italy (+45%) and in Spain (+49%) they rose faster in spite of a clear deceleration after the crisis. In France they rose even faster still (+52%).

A development like this raises the issue of whether the euro zone aims to become a true single currency or simply an adjustable exchange rate via the compression of wages and prices as was the case when there was market pressure between 2010 and 2012 by way of the sovereign debt.

The return of growth which has progressively gathered pace across the entire euro zone including in a country like France which was the slowest to launch the business reforms initiated by all of the single currency member states, provides a valuable opportunity to address matters clearly. The structural imbalances of the euro zone Member States, which revealed a competitiveness crisis that morphed into a financial crisis, were not due in reality little to the austerity programmes of the 2010's, but rather more to national policies, which leapt at the opportunity offered by the transfer over to the euro to undertake autonomous policies free of any external constraint, which readily allowed financial bubbles to form (real estate, public debt etc ...) .

Contrary to the theories put forward by their adversaries, the policies introduced since 2010 allowed structural conditions to be created that enabled an improvement in the international economic situation (decrease in energy prices, the dollar and exchange rates), notably on the labour market, including amongst young people. Since 2013 when it reached its highest level, unemployment has dropped from 12 to 9% in the euro zone. In the countries of the South it has returned to 9.8% in Portugal, 11.7% in Italy, 18% in Spain and 23.5% in Greece. But the disparities have far from disappeared if we compare these figures with the level in Germany where it totals 3.5%. The structural dimension of European disparities is effectively highlighted by unemployment. Although reforms and the economy have led to a significant decline in youth unemployment since 2013 it is still particularly high: 48% in Greece, 40% in Spain and 34% in Italy.

It is difficult to imagine a worse situation in terms of undermining the adherence of national societies to the European project since in spite of the reforms undertaken at national level and institutional reforms across the euro zone it has accentuated the rupture between Northern and Southern Europe and the contrast between a convalescent economic Europe and a social Europe which is declining into mass unemployment.

This is why social Europe remains an imperative in response to citizens' expectations in terms of the legitimacy of political integration. In this regard social Europe cannot be limited to the compassionate. It involves turning the European social dimension into a powerful lever to revive a competitiveness strategy to raise growth rates in the euro zone. Civilisation is also at stake, because, above all Europe embodies the highest respect of human dignity by way of its social economic market model, which is officially laid out in the treaties. Social integration and effective competitiveness are two aspects of the same strategy.

What kind of Europe do we want?

A grand market vs political integration: a conflict of goals

Twenty five years after Maastricht two goals continue to be inherent to Europe, which as time passes, have increasingly become rivals. First there is the Europe as a grand market.. In this regard the community's institutions are especially oriented to establishing rules which unify and facilitate the markets. The other project is of a political nature: it deems that Europe's final goal is political integration. Hence the euro is the engine in a dialectic process striving for monetary and then budgetary integration and from there on to political integration, in virtue of the fundamental principles of representation: no taxation without representation. From this standpoint, poltical factors - such as the exit of the UK expressed in the referendum, election in France in 2017 of Emmanuel Macron and the reassertion of the political nature of the European project in a speech delivered at the Sorbonne (26th September 2017), - have created an opportunity to give the European project with a complete dimension in its own right.

Competing alongside these two goals is the Europe of methods. On the one hand, after Maastricht, Europe approved the method of competition between States by way of the discretionary use of fiscal and social norms in national policies: hence in spite of a significant European bail-out (€45 billion) which it benefited from at the height of the crisis Ireland has until now refused to modify its corporate tax rate of 12.5%. On the other hand the settlement of the sovereign debt crisis ended quite logically in tighter community supervision of national budgetary policies and an identical standard in terms of deficits. In one instance we have competition and integration in another. We should highlight the fundamental difference between the two. In an integrated economic area competition occurs in goods and services markets in which social and fiscal standards are mainly homogeneous. Identical rules are not necessary as on a national level. Differences between tax rates and contribution levels help to iron out differences in productivity from one region to another but their limited nature does not cause competition between regions. Hence in the USA competition is encouraged on the goods market but in terms of governing standards it is strictly limited; the same goes for Germany, a cooperative model of federalism: Lower Saxony does not aim to relocate companies based in Bavaria. On a European level it is very different: some States openly use fiscal and social standards to foster the relocation of businesses or workers from other European States.

The restoration of the Welfare State: a European issue

With the choice by most European countries of an ambitious Welfare State pursued since the Second World War - social spending represents 26% of Germany's GDP, 33% in France - social transfers have played a major role in the formation of macro-economic imbalances between the euro zone States, whilst the single currency prevents their adjustment via devaluation. Moreover, in a system of set exchange rates, as in an optimal monetary zone, adjustment occurs via real flows in virtue of the mobility of labour and capital, but in this case the markets are integrated by standards. If the unemployed do not find work in one State where activity is declining, they find work in another where activity is increasing. Compensation takes place on a federal level which unites these two States. This is the case in the USA. This is what happens in Germany where there is both a federal level which plays the role of "compensation chamber" and in virtue of "cooperative federalism rules", which includes equalising mechanisms between poor and rich Länder. On the other hand however the deficit standards of the Länder are strictly defined.

. Changes to social norms via public spending stimulate or impede domestic demand. If this exceeds a State's output the latter will see a deficit in its external balance; in the opposite case it will be in surplus. Two situations then emerge: either the State in surplus accepts to pay his neighbour's deficit, who in exchange then issues debt securities; or it refuses and the State in deficit has to reduce its demand unilaterally, because there is no devaluation, by reducing its production costs and by cutting its public and social spending.

In the countries of Europe social spending often represents an overwhelming share of total public spending. Its macro-economic role in an integrated monetary zone is therefore of major importance because of its impact on the increase or, the converse, the reduction in tension in terms of current deficit and surplus between States and also because of its weight in labour costs and in the formation of unemployment rates. In other words, whilst social spending, and the way it is financed affects labour costs, probably plays the most important role in the functioning of the euro zone, it is still the competence of national policies: it is not coordinated and are far from being integrated - much less than the State budgets whilst its federal integration would enable it to play a more effective role in an economic zone comprising States which share the same currency.

The adoption of the same currency by 17 European States radically changed the nature of everything social. For example, when Germany introduced the Deutschemark (DM) into the Länder in the east it had to consent to significant transfers: 4% of the GDP of the Western Länder for a 20 year period. For the Europe of the euro the paradox was that at the height of the crisis we saw it provide major federal means to resolve crises and to guide national budgetary policies. But it was national solutions which settled structural issues - the labour market, the Welfare State - which challenged each State in a similar manner. The issue of restoring the Social State has been raised in almost the same way for the last twenty years. Most euro zone States have adopted a Bismarkian-type social protection regime, in other words one that is based on a logic of insurance, which mainly relies on contributions shared by employers and employees. The issues raised by the ageing population are almost the same everywhere: the fertility rate is the same in Italy, Spain and Germany - 1.3 and although countries like France have a higher rate - 1.8 - it is still below the required level of 2.1 - to guarantee the renewal of the population.The challenges faced by retirement systems are the same across the entire euro zone. The solutions that are implemented also highlight true convergence, notably regarding the age of retirement that tends towards 65 in most Member States.

No collective solidarity without individual responsibility

To some extent we might be pleased at this natural convergence towards European solutions. But the sum of 19 national solutions does not have the same clout, does not have the same economic and social power as an overall European solution. This is firstly because of the differences in dimension, national in one instance and European in the other. Hence it is because Europe - and this is also true within a State - comprises healthy regions and others which are not. In other words, if we reason as if there were implicit balances of payment, some regions which produce surpluses: Ile-de-France, Baden-Württemberg and some produce deficits: Mecklenburg-Western Pomerania, Limousin. This means that in the present organization of the euro zone Ile-de-France automatically pays Limousin's deficit, Baden-Württemberg that of Mecklenburg-Western Pomerania. But Ile-de-France does not help Baden-Württemberg pay off Mecklenberg-Western Pomerania's deficit nor does Baden Württemberg support Ile-de-France in the effort towards paying off Limousin's debt.