Economic and Monetary Union

Patrice Cardot

-

Available versions :

EN

Patrice Cardot

Retired senior government official responsible for European affairs

Part One

On 30 October, the ECB launched the next phase of the digital euro project. To shed light on the underlying motivations behind central bank digital currencies (CBDCs), which are often misunderstood or reduced to a simple ‘modernisation’ exercise, we are publishing a detailed study, which will be available in two parts. These central bank digital currencies are not just another technological innovation; they are symptomatic of a world where monetary sovereignty is now played out on digital chessboards. China has understood this by rolling out its digital yuan in eighteen countries. The United States is procrastinating, but its dollar remains the gold standard. Europe is still hesitating between two futures: that of a renewed monetary power or that of a marginalised player, dependent on the choices of others. The rollout of the digital euro by 2027 is no longer an option. It is a strategic necessity, provided that the current shortcomings are corrected: lack of emergency governance, cyber vulnerabilities, silence on the regulation of private players. Time is running out. This first part of the study explores this silent revolution by showing how central bank digital currencies are redefining the global balance of power.

1. The three strategic dimensions of CBDCs: monetary, financial and economic

A. The monetary dimension: regaining control over the creation and circulation of money

a) Restoring monetary sovereignty in the face of cryptocurrencies and private stablecoins

Since the emergence of Bitcoin in 2009, followed by stablecoins (USDT, USDC) and private currency projects (Meta's Libra/Diem, JPM Coin), governments have lost some of their monopoly on money creation. In 2025, 10% of Europeans hold cryptocurrencies, and stablecoins account for 15% of cross-border transactions in Asia.

The risk would be to end up with a disintermediation of central banks, where citizens and businesses turn to private currencies, escaping state control. For example, in 2022, El Salvador adopted Bitcoin as legal tender, reducing its dependence on the dollar... but at the cost of extreme volatility and a loss of monetary control.

CBDCs enable central banks to reassert their role as guarantors of monetary stability and offer a public alternative to private currencies, with the same advantages (speed, reduced cost) but without the risks (volatility, opacity). For example, the Chinese digital yuan is designed to replace stablecoins (such as USDT) in Asian exchanges, while allowing the PBoC to control every transaction.

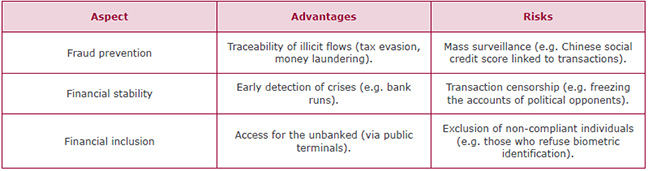

b) Combating tax evasion and money laundering

Cryptocurrencies and stablecoins are often used to circumvent financial regulations: 60% of Bitcoin transactions in 2023 were linked to illegal activities, according to Chainalysis. This could lead to capital flight to tax havens or opaque jurisdictions, weakening government tax revenues.

CBDCs ensure full traceability of transactions, helping to combat fraud and tax evasion. The digital yuan allows China to monitor capital flows and block suspicious transactions in real time.

c) Adapting monetary policy in the digital age

With the gradual disappearance of cash (less than 20% of transactions in Europe in 2025), central banks are losing a key tool for transmitting their monetary policy, as negative interest rates are less effective if citizens hoard cryptocurrencies. This could lead to a loss of effectiveness of traditional tools (key interest rates, QE), limiting the ability of governments to stimulate the economy in the event of a crisis.

CBDCs allow liquidity to be injected or withdrawn without going through commercial banks, improving the effectiveness of monetary policy. In the event of a recession, the ECB could thus credit citizens' digital euro accounts directly, bypassing the delays of traditional banking systems.

B. The financial dimension: securing the system and reducing dependencies

a) Reducing dependence on the dollar and foreign payment systems

The dollar still dominates 60% of global reserves and 80% of commercial transactions (oil, gas). US sanctions, such as Russia's exclusion from the SWIFT system in 2022, have shown that this dependence is a major geopolitical risk. It can result in vulnerability to sanctions such as the freezing of Russian dollar reserves, or to exchange rate manipulation. China is using the digital yuan to circumvent restrictions on the renminbi.

CBDCs create a sovereign alternative for international trade. China, for example, uses the digital yuan to pay for its purchases of Iranian oil, circumventing US sanctions. For Europe, the digital euro could be used for gas payments with Russia or Algeria, reducing dependence on the dollar.

b) Limiting systemic risks linked to cryptocurrencies and stablecoins

Stablecoins (such as USDT) and cryptocurrencies are under-regulated and can trigger financial crises like the collapse of TerraUSD in 2022, which caused a loss of £30 billion in 48 hours. This can lead to contagion in traditional markets; banks exposed to stablecoins could go bankrupt, as Silicon Valley Bank did in 2023.

CBDCs offer a stable and regulated alternative, limiting the appeal of speculative assets. If the digital euro is perceived as being as convenient as stablecoins but more secure, citizens and businesses will adopt it en masse.

c) Strengthening resilience to cyberattacks and financial crises

Traditional payment systems (SWIFT, SEPA) are vulnerable to cyberattacks, as demonstrated in 2016 by the attack on the Central Bank of Bangladesh, in which $81 million were stolen. They are also susceptible to systemic failures, such as the Visa outage in Europe in 2018. A paralysis of transactions could result in costs estimated at 0.5% of GDP per day, according to an ECB estimate for 2023.

CBDCs provide a decentralised and redundant architecture offering backup nodes, as in Iceland or the Canary Islands, or continuity plans with automatic switchover to SEPA or cash in the event of a failure. Sweden, with its e-Krona, is testing offline backup systems to avoid paralysis in the event of a cyberattack.

C. The economic dimension: stimulating innovation and inclusion

a) Modernising payments and reducing transaction costs

Current payment systems are slow (2-3 days for an international transfer) and expensive (3-5% fees for cross-border transactions). European SMEs could lose €30 billion a year in bank charges, according to a 2024 European Commission study.

To remedy this, CBDCs are introducing instant and virtually free payments, even internationally. With the digital euro, a French SME could pay an Italian supplier in real time and without fees, compared to 2-3 days and 3% commission at present.

b) Combating financial exclusion and promoting inclusion

According to a 2025 study by the World Bank, 5% Europeans (20 million people) do not have access to a bank account and 15% depend on cash, the use of which is declining. A digital divide could exacerbate social inequalities.

CBDCs ensure universal access, even without a smartphone, via prepaid cards or public terminals. In Estonia, where 99% of public services are digitised, the e-Krona could be adopted by rural populations via public terminals.

c) Stimulating financial innovation and smart contracts

---------------------------------------------------------------------------------------------------------------------

A smart contract is a self-executing computer program that automatically enforces the terms of a contract when predefined conditions are met, without an intermediary (bank, solicitor, judge), for example automatic payments, public subsidies, insurance.

Why is this revolutionary?

- Speed: execution in seconds (vs. weeks/months for traditional contracts).

- Transparency: the code is public and tamper-proof (blockchain technology).

- Reduced costs: 0% intermediary fees (vs. 3-5% for banks).

- Security: impossible to modify once deployed (except for bugs in the code).

Risks and limitations:

- Code errors: a bug can block millions (e.g. the DAO hack in 2016, $60 million stolen).

- Unclear legal framework: who is liable in the event of a dispute? But the courts are beginning to rule on this.

- Technological dependence: it requires a reliable infrastructure (e.g. Ethereum blockchain).

The integration of smart contracts into the digital euro would enable automatic social assistance, conditional payments and the fight against fraud.

---------------------------------------------------------------------------------------------------------------------

European fintechs (Revolut, N26) and American giants (PayPal, Stripe) dominate financial innovation, leaving Europe dependent on private players. This could lead to a brain drain and capital flight to the United States or China.

CBDCs enable the integration of smart contracts for innovative uses such as programmable payments (social benefits paid automatically under certain conditions) or crowdfunding (fundraising for green projects). Brazil, with its DREX, already uses smart contracts to automate agricultural subsidies.

2. The underlying motivations: why are states entering this race?

Behind every CBDC lies a fear: that of losing control, becoming dependent or missing the boat.

A. Fear of the collapse of the current monetary system

This fear is linked to the decline of cash and the rise of cryptocurrencies. In 2025, cash will account for only 20% of transactions in Europe, compared to 50% in 2010. Central banks are losing their grip on physical currency. Without CBDCs, they risk becoming obsolete, replaced by private players (stablecoins, cryptocurrencies). Furthermore, in 2024, one in ten Europeans owned cryptocurrencies, and 30% of young people used them for everyday payments. This could lead to digital dollarisation, where citizens adopt private assets (USDT, Bitcoin) on a massive scale to the detriment of sovereign currencies. However, governments have realised that if they do not create their own digital currency, others will do so in their place. And this will not be a benign development.

B. The fear of geopolitical dependence

This fear is linked to the use of the dollar as a weapon and the digital yuan as a counterattack. US sanctions, such as the freezing of Russian reserves in 2022, have demonstrated that the dollar is both a shield and a sword. As a result, countries such as China, Russia and Iran are desperately seeking an alternative. For example, Beijing is using its CBDC to circumvent sanctions (oil payments with Iran), impose its standard in Asia (eighteen partner countries in 2025) and monitor capital flows (fight against tax evasion). China therefore does not just want a digital currency: it wants a world where the dollar is no longer king. And Europe seems to be watching, sceptical, without really choosing sides.

C. Fear of speculation and financial crises

We must learn from the lessons of 2008. The financial crisis showed that traditional banking systems are fragile. A new crisis could be amplified by cryptocurrencies and stablecoins (e.g. the collapse of TerraUSD in 2022). CBDCs can act as a safety net, offering both guaranteed stability (unlike volatile cryptocurrencies) and control over cash flows (limiting speculative bubbles). In the event of a stock market crash, a CBDC would allow central banks to inject liquidity directly into the hands of citizens, without going through fragile intermediaries. CBDCs are therefore not a fad for technocrats. They are parachutes. And in a world where financial crises recur every ten years, it is better to have one.

3. The grand chessboard of digital currencies: a silent war

A. Central bank currencies: weapons of economic conquest

On the global chessboard, each piece moves with strategic intent. Here are the players, their moves, and what they reveal about their nations' ambitions.

China

Beijing is not building a currency. It is forging a weapon. The e-CNY is not just a payment tool. It is an instrument of power, designed to circumvent US sanctions: in 2024, Iran and Russia began settling part of their energy trade in digital yuan, thus escaping the net of dollar restrictions. Oil for digital yuan has become the new mantra for countries under embargo. It is also about controlling capital flows. With absolute traceability, Beijing can monitor every transaction, combat tax evasion and even rate the financial behaviour of its citizens (integration with the social credit system). It aims to replace the dollar in Asia. In 2025, the digital yuan is already used in eighteen countries, from Thailand to Kazakhstan and the United Arab Emirates. One payment, one road: the new digital ‘Silk Road’.

But this weapon has its weaknesses, such as resistance from citizens. Even in China, adoption is uneven. The Chinese, accustomed to cash and WeChat Pay, are wary of this 100% traceable currency. They also fear technological dependence, as a major cyberattack on the servers of the People's Bank of China (PBoC) could paralyse the system. This would represent a digital Achilles heel. Finally, this weapon has led to international mistrust. China's Western partners (such as Germany) refuse to adopt the digital yuan for fear of Beijing gaining control over their transactions.

The USA

Unlike China, the United States is dithering. Their digital dollar, still in the planning stages, is being held back by political divisions. Congress, divided between Republicans and Democrats, is currently blocking any significant progress. The Fed wants to act, but Congress says no. Furthermore, the power of private stablecoins such as Circle (USDC) and Tether (USDT) is already capturing part of the cross-border payments market. Why create a digital dollar when the private sector is already doing so? Finally, the dollar's current hegemony remains intact, and ‘if it ain't broke, don't fix it’. The greenback still dominates 60% of global reserves. Paradoxically, an American CBDC could weaken this dominance by fragmenting the system. The United States is playing with fire. By waiting too long, it risks seeing its digital currency arrive too late... and leaving the field open to China.

Other players: innovation and caution

• The UK (Britcoin): London is banking on post-Brexit financial innovation, but the project remains overly cautious, limited to sandbox testing.

• Japon (Digital Yen): Tokyo is preparing an alternative to the digital yuan, but without urgency. Caution is a virtue, but also a risk.

• Sweden (e-Krona): Stockholm, where cash has almost disappeared, is testing an open-source digital currency with partial anonymity for small payments. A model for Europe?

• Brazil (DREX): Brasilia integrates smart contracts for social assistance, demonstrating how a CBDC can promote financial inclusion.

Each country is writing its own score. But Europe still seems to be searching for its melody.

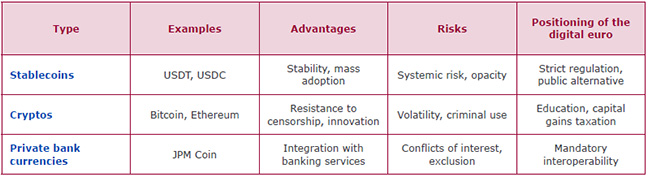

B. Private currencies: the privateers of the 21st century

Digital currencies are not just the preserve of governments. Private players also have their pieces on the chessboard. And their moves are often more daring.

a) Stablecoins: the Trojan horse of financial giants

USDT, USDC, DAI… These three could well redefine European monetary sovereignty.

USDT (Tether) has 130 million users, mainly in Southeast Asia, but operates with complete opacity. No one really knows what assets back these tokens. If Tether collapses (like TerraUSD in 2022), it could trigger a systemic crisis.

USDC (Circle) is more transparent, but controlled by private players (BlackRock, Coinbase). The challenge is that a private currency could marginalise the digital euro if Europe does not react.

Stablecoins are like octopuses: their tentacles spread everywhere, and before we know it, they will have suffocated sovereign currencies.

b) Cryptocurrencies: anarchy as a system

Bitcoin, Ethereum, Solana... Currencies with no master, or almost none. Their strengths include a certain resistance to censorship, as they are impossible for a state to control. They also represent a financial innovation: DeFi, NFTs, smart contracts... and therefore a revolution in progress. They are becoming increasingly popular: 10% of Europeans now own cryptocurrencies.

But they do present risks, including extreme volatility: Bitcoin is down 80% in 2022 but up 300% in 2024. They are used for criminal purposes: ransomware, the darknet, money laundering. They also have a significant environmental impact: Bitcoin requires high electricity consumption in Sweden.

Cryptocurrencies are like fire: they can heat a house or reduce it to ashes. It all depends on who controls them.

c) Private bank currencies: the return of feudal lords

JPMorgan, Meta, Goldman Sachs... Banks want their own currency. And this is dangerous.

• JPM Coin (JPMorgan) is used for interbank transactions. It is a currency for insiders. The risk is that it will create a two-tier system, where citizens do not have access to the same tools as businesses.

• Libra/Diem (Meta). Admittedly, the project has been abandoned, but the idea remains: a private currency for 2.8 billion Facebook users, with the underlying principle that whoever controls the currency controls the power.

In a way, private banks want to return to what they were in the Middle Ages: feudal lords, controlling both the economy and politics. If the European Union does not regulate stablecoins and give the digital euro clear added value (resilience, smart contracts), citizens and businesses may prefer private solutions.

Mapping of stakeholders (2025)

4. Systemic impacts of CBDCs: a reshaping of international monetary and financial balances

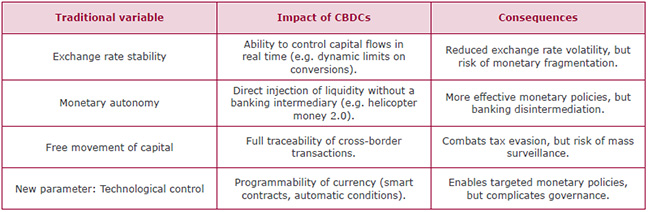

Central bank digital currencies (CBDCs) are not simply a technological development, but a paradigm shift in the international monetary architecture. Their emergence challenges three fundamental pillars: traditional monetary doctrine (Mundell-Fleming trilemma, independent monetary policy), the stability of the international financial system (role of the dollar, geopolitical balances) and the dominant banking model (financial intermediation, credit creation).

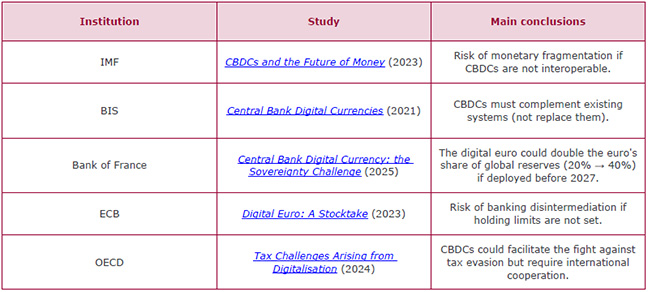

This chapter analyses these effects using a systemic approach, drawing on available studies (IMF, BIS, ECB) and forward-looking scenarios. The issue is not only technical, but also geostrategic: CBDC's are redefining the balance of power between states, central banks and private actors.

A. Redefining monetary doctrines: towards a new orthodoxy?

a) The Mundell-Fleming trilemma revisited: the emergence of a fourth pillar

The theoretical model of the trilemma (a country cannot simultaneously have exchange rate stability, monetary autonomy and free movement of capital) is being disrupted by CBDCs. These introduce a fourth variable: technological control of currency. China, for example, uses the digital yuan to impose conversion limits based on its partners' trade balances. In 2024, Iran was only able to convert 30% of its digital yuan into other currencies, thereby limiting capital flight.

b) The end of "controlled" inflation? The challenge of programmable money supply

CBDCs enable algorithmic management of the money supply, challenging traditional models (e.g. Taylor rule). They offer several advantages: precision and, in particular, real-time adjustment of monetary aggregates (M1, M2); efficiency due to direct transmission of monetary policy to economic agents, without ‘leakage’ via commercial banks. Sweden is considering using the e-krona to automate social benefit payments, reducing processing times from five days to zero.

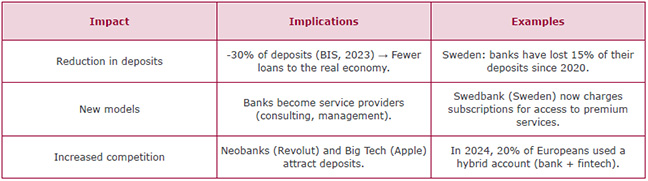

On the other hand, they may pose risks: instability, as a programming error could trigger a deflationary spiral (blocking transactions in the event of a bug), or disintermediation. According to a 2023 BIS study, widespread adoption of CBDCs could reduce bank deposits by 20-30%, weakening the credit system. A Fed study shows that in the United States, a flight of deposits to a digital dollar could reduce lending to SMEs by 15%.

c) The end of anonymity: Towards a 'panoptic' currency?

CBDCs remove the anonymity of cash, introducing a democratic paradox:

In 2023, the PBoC froze the digital yuan accounts of 1,200 citizens who had participated in protests, without prior judicial decision.

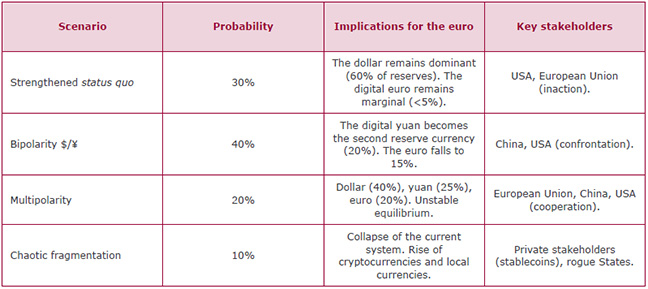

B. Impact on the international monetary system: towards a multipolar or fragmented world?

a) The end of the dollar's hegemony? Forward-looking scenarios

The dollar still accounts for 60% of global reserves (2025), but CBDCs could accelerate its decline.

According to a 2025 IMF analysis, if the digital euro captures 10% of global reserves by 2030, this could strengthen European sovereignty (by reducing dependence on the dollar), but also trigger tensions with the United States... which could then restrict access to SWIFT for digital euro transactions.

b) Financial stability: between resilience and systemic risks

CBDCs introduce new systemic risks:

• Cyberattacks: an attack on the ECB's validation nodes could paralyse payments in Europe for 48 hours, at a cost of 0.5% of GDP per day. With CBDCs, the impact would be tenfold. It would be estimated at €50-100 billion for the European Union.

• Digital bank runs: if citizens convert their deposits en masse to CBDCs, banks could face a liquidity crisis.

• Technological dependence: A failure of the European electricity grid (e.g. cyberattack) could render CBDCs unusable, triggering a crisis of confidence.

c) Transformation of the banking system: towards a 'post-intermediation' model?

CBDCs could marginalise commercial banks:

C. Impact assessments and prospective scenarios (2020-2025)

a) Institutional studies

b) Specific studies on the digital euro

A 2024 study by the Bank of France presents an optimistic scenario in which the digital euro could increase the euro's share of global reserves from 20% to 30% by 2030, if it is deployed with innovative features (smart contracts, programmable payments). However, it also presents a pessimistic scenario: if the digital euro is too restrictive (holding limits, absence of smart contracts), it could capture only 5% of transactions, marginalised by stablecoins (USDT, USDC).

• The European Commission predicts an impact on SMEs in 2023. Widespread adoption would reduce transaction costs by 60% but could reduce access to loans if banks lose deposits. It would also have an impact on citizens: 90% of Europeans could adopt the digital euro if it is as simple as stablecoins, but only 40% if it is perceived as overly controlled (e.g. strict holding limits).

• According to Europol, in 2025, a successful attack on the digital euro could cost the European economy up to €200 billion, leading to paralysis of payments and even a loss of confidence. It recommends creating a dedicated crisis unit with a budget of €10-15 billion per year.

D. Strategic recommendations for the European Union: avoiding pitfalls, seizing opportunities

To safeguard international monetary stability, it would be advisable to cooperate with the IMF and the BIS to establish rules for interoperability between CBDCs (to avoid a currency war), to limit massive conversions between CBDCs to avoid currency crises (digital euro-digital yuan conversion ceiling) and to create a stabilisation fund (€50-100 billion) to intervene in the event of a run on CBDCs.

To modernise the banking system without destroying it, setting limits on digital euro holdings (e.g. €3,000 per citizen) to prevent bank deposit flight, requiring banks to offer hybrid services (digital euro accounts + traditional loans) and taxing speculative transactions (e.g. 0.1% on digital euro-cryptocurrency conversions) would be useful.

To strengthen the resilience of the system, the objective would be to create a ‘European Monetary Emergency Authority (EMEA)’ with a clear mandate to intervene within two hours in the event of a cyberattack, and extensive powers to freeze fraudulent transactions. It would also involve developing redundant validation nodes (Iceland, Canary Islands, Germany) to avoid a single point of failure and providing a plan B, such as an automatic switch to SEPA or cash in the event of a prolonged outage.

To make the digital euro a geopolitical lever, Europe should promote its adoption in trade with Africa (franc zone) and Latin America, link it to climate objectives (programmable payments for green subsidies) and negotiate with the United States to avoid a currency war (agreement on limits on the use of the digital dollar in Europe).

***

CBDCs are not simply a technological development. They represent the biggest overhaul of the international monetary system since the Bretton Woods agreements in 1944. Europe finds itself at a crossroads:

• either endure the transition: for example, by allowing the digital yuan to dominate Eurasian trade, or watch private stablecoins (USDT, USDC) capture a growing share of transactions, or finally risk a systemic crisis in the event of a cyberattack or bank run…

• … or master the transition: by making the digital euro a tool of sovereignty, with smart contracts, emergency governance, and controlled interoperability with other CBDCs. It also needs to reduce transaction costs for SMEs and citizens and strengthen the euro's position in global reserves (target: 30% by 2030).

The time for procrastination is over. Europe must choose between leadership and marginalisation. The die has already been cast. It is up to Europe to decide whether it wants to be a player or a spectator in this monetary revolution.

Publishing Director : Pascale Joannin

To go further

Agriculture

Bernard Bourget

—

17 February 2026

European Identities

Patrice Cardot

—

10 February 2026

The EU and Globalisation

Olena Oliinyk

—

3 February 2026

Strategy, Security and Defence

Jean Mafart

—

27 January 2026

The Letter

Schuman

European news of the week

Unique in its genre, with its 200,000 subscribers and its editions in 6 languages (French, English, German, Spanish, Polish and Ukrainian), it has brought to you, for 15 years, a summary of European news, more needed now than ever

Versions :